2020 was a year when the retail market faced many problems due to measures to prevent the spread of the COVID-19 virus, which has resulted in almost 100% shutdowns for a long period of time. However, the situation had gradually improved from the third quarter to the end of 2020.

Although there has been some disruption because of the second wave of covid-19 spread, but when the event was not as severe as in the middle of the year. People are not afraid to come out to buy products in various retail projects, therefore, the situation began to return to normal again.

Although the incident seems to be returning to normal in 1Q 2021, all restaurants and services still under continuous surveillance policy. In addition, Thailand’s economy has been in a slowdown since before the COVID-19 situation. As a result, the overall picture of the retail space market in the first quarter of 2021 has slowed down and began to see more empty spaces in various projects. Many tenants are closing up or claiming space for rent as they are unable to bear expenses during the period of continuous decline in income for a year. The January 2021 retail index stood at 234.07, close to the third quarter of 2020 and a 13% drop from December 2020. This downturn clearly shows that the merchants and operators of various retail projects is in a condition that has not yet recovered from the past year

Supply

Bangkok and Surrounding Area Retail Market as of Q1 2021

Source: Phoenix Property Development and Consultancy

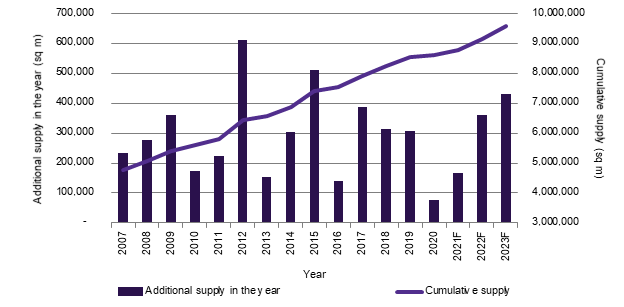

Bangkok and surrounding area retail market in the first quarter of 2021 continued to slow down from 2020. Because of the epidemic that began to occur in the late year in succession in early 2021, it affects the confidence and spending of many Thais. Although, there is no announcement of the closure of the retail project. but it has resulted in some people choosing to reduce their access to the retail projects as they do not want to be in a crowded place. However, it still has not had hard impacts similar to the first half of 2020. It may have a more pronounced effect on the retail project if there is a widespread outbreak in Bangkok.

Although the new epidemic in the first quarter of 2021 did not occur in Bangkok, nut it has resulted in some retail tenants choosing to close their own shops or rental spaces and request for contract termination as the income is not continuous and not enough for spending. Closing or returning a lease is the ideal choice for small to medium-sized tenants. Bangkok’s retail space as of Q1 2021 was approximately 6.5 million square meters. But if we combine the continuous area with Bangkok, it will be approximately 8.6 million square meters. Several retail projects that are currently under construction have the possibility of being postponed due to lack of labor.

Retail spaces in Bangkok and surrounding areas of Bangkok

Source: Phoenix Property Development and Consultancy

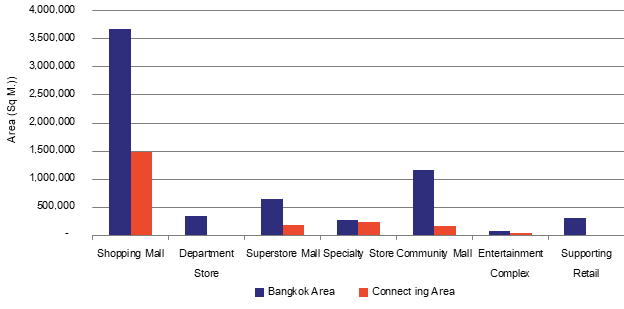

As of 1Q 2021, retail space in Bangkok and surrounding areas was approximately 8.6 million square meters, of which 76% of the total retail space was in Bangkok. Especially shopping malls in Bangkok than in the surrounding areas clearly. The same applies to the area of the department store outside the shopping center and supporting retail areas located in Bangkok only. This may be because it is a project that is more suitable for living in Bangkok than other areas. Even community malls, a form of retail space developed to serve the community, are more clearly located in Bangkok area.

The specialty store may be a retail format that does not differ much in the area in Bangkok and surrounding areas. This type of project has a clear target group that is a group of people who have just bought a home and want to buy products for home decoration. There may be a branch in Bangkok, but it is in the suburbs of Bangkok.

Demand

Average Occupancy Rate of All Retail Projects by Categories and Location

Source: Phoenix Property Development and Consultancy

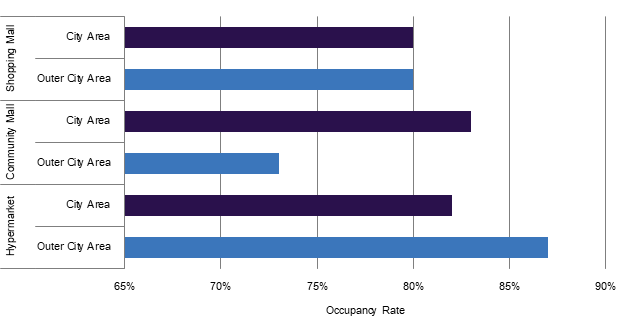

The occupancy rate in small retail projects or a project with a small rental space. such as a community mall and hypermarkets, began to see empty spaces or contract termination request. Some areas in shopping malls have also begun to have empty spaces. This has resulted in a decrease in the overall average occupancy rate. Although the occupancy rates of various categories of retail projects is still higher than 80%, but it is down about 5 – 10% from the past depending on the location and project format. Community malls may be the type of retail project with the biggest drop in occupancy rates in recent months.

Although there are some tenants who request to return the rental space. But there are also large tenants who are international brands, both selling consumer products and consumption that came to find rental space which saw the opening of branches or opening stores of various brands these continued over the past several months. If the economic situation still does not recover and there will still be a wave of COVID-19 epidemic occurring in the past, there will definitely be emptier spaces and may affect some retail projects as well. Restaurants or groceries stores may be very popular in recent months, some retail projects have more people entering the project, because of the popular or trendy restaurants.

Rental Rates

Average Rental Rate of Retail projects by Categories

Source: Phoenix Property Development and Consultancy

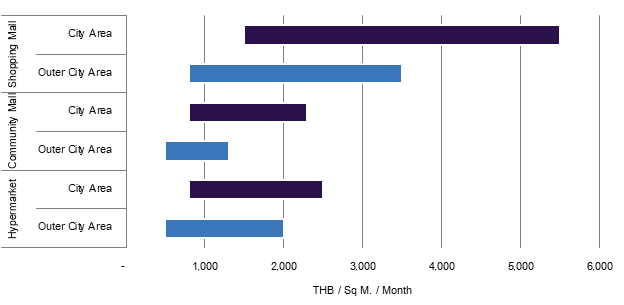

The overall rental rate may not change much as developers and project owners may not have a substantial reduction in rent or an abrupt reduction. However, there may be a reduction in rent for only 1 – 2 months only. But there may not be a rental adjustment for a tenant who already has a lease and wants to extend the lease.

The overall picture of Thai people’s spending still does not return as it was before the time of the epidemic. Therefore, many tenants have had ongoing financial problems over the past several months. Although selling products online can help a bit but they are not continuous and long-term plan. However, there are already a lot of online products, perhaps only food has received quite a lot of attention over the past several months as people work at home in Bangkok.

Summary of overview and future trends

Retail project has not yet recovered or returned to normal in Q1 2021 and continues to be viewed for the remainder of 2021.

The retail space market will continue to be affected until social distancing is not taken into account.

The retail project in the city center area, the area where a portion of the customer group is foreign tourists, will not recover until it is opened for foreigners to freely enter Thailand.

Many tenants have had to close their businesses temporarily or permanently in recent months.

Rents and rental rates are likely to decline in 2021.

Tenants with online product sales channels will begin to reduce their rents in retail space projects.

Organizing activities in the retail project will still be limited.

Community mall or small retail projects without any activities will can see more empty space.

The retail project in the future will begin to reduce the number of new projects, because the pattern of purchasing the product has changed.