“The condominium market

in Thailand clearly slowed

down, due to the economic

slowdown. Because of the

impact of the COVID-19

virus outbreak.”

The condominium market in Thailand clearly slowed down, due to the economic slowdown. Because of the impact of the COVID-19 virus outbreak, this has a direct effect on changing lifestyle and work, especially during the lockdown period in Bangkok and many other provinces. Although it began to relax in the third – fourth quarter, but the outbreak was finally detected again in mid-December and everything seems to be back in the second quarter situation again.

But it seems this time may be more severe than the first time in the second quarter of this kind of epidemic in late December. It definitely affects the atmosphere of tourism and celebrations. In addition, many developers need to reconsider their investment plans in 2021.

Supply

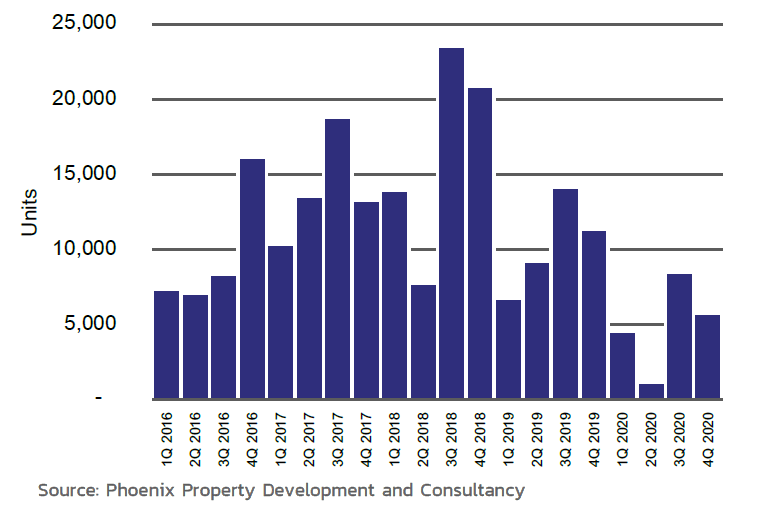

New condominium launches by quarter in Bangkok as of Q4 2020

New condominium launches in Q4 2020, there are approximately 5,760 units, a 32% decrease from the third quarter. Even though this is more than the first and second quarters of this year, but it is still lower than the same period of many years ago. Total number of new condominiums units launched in 2020 are approximately 20,060 unit and this is the lowest total number of new condominium units launches in the past 10 years. There are many projects are non-official pre-sale. Although the sales office is complete, but still unable to visit normally and the official launch date will be in year 2021.

Real estate business, especially housing and condominium projects has been impacted by a decline in confidence, prompting a number of people to not want to buy new homes and creating long-term debt obligations. They are also not confident in economic situation and their own financial condition in the long term. Moreover, the measures related to the consideration of bank credit are more stringent, because of every commercial bank does not want to increase the burden of bad debt as well. But developers did not want to have a drop in income during the crisis and tried to release as much of their stock as possible. But now, people do not want to spend a lot of money and the way to make it more interesting is that there are only discounts and extra promotions. Therefore, over the past several months many developers have seen many of the completed condominium projects come out at a huge discount. Reducing the opening of new condominium projects and increasing the proportion of housing projects is another way that developers adopt in 2020.

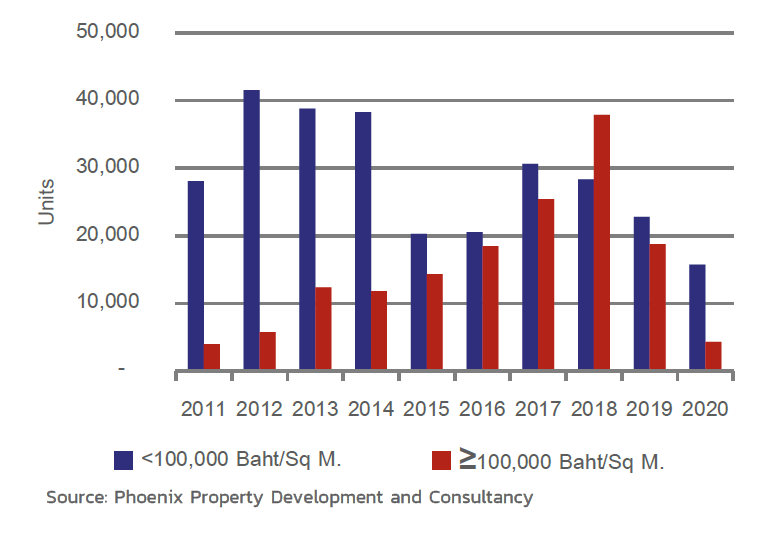

New Condominium Launches in Bangkok by Price Range and Year as of 4Q 2020

Condominiums in the price range below 100,000 baht per square meter are the selling price range that developers are interested and also the selling price range. It is also the selling price range corresponding to the largest buyer group in Bangkok. It can be seen from the year 2011 the condominium sales price range is lower than 100,000 baht per square meter there are clearly more condominiums at a higher price range. Except for 2018 that developers increase to launch the new condominium project with a price range more than 100,000 baht per square meter. This is because there are more projects in the price range of 100,000 – 150,000 baht per square meter than other projects in the price range.

During the times when the economy tends to be very positive or growing at high level, developers will increase the proportion of more expensive condominium projects to comply with the increasing purchasing power. But when the economy is in a declining trend or most people lack confidence in spending. Developers will increase the proportion of projects with a selling price of less than 100,000 baht per square meter.

Demand

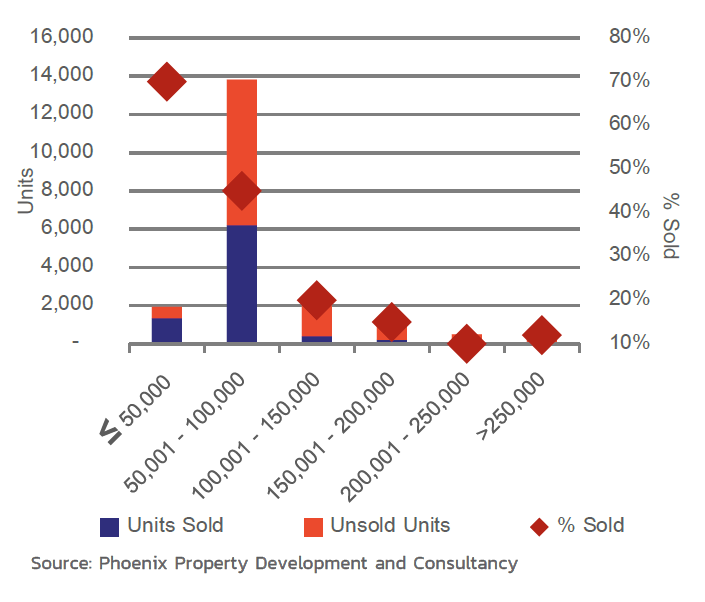

Average Take-Up Rate of New Condominiums Launched in 2020

Average selling rate of new condominiums launched in 2020 is about 40% may not look much or less. But it reflects the economic condition and the confidence of purchasing power is in a clear recession. Although there are many projects that have a high take-up rate or can sold out shortly after the official launch. Which will be a project in a good location near university and able to attract the attention of both groups of investors as well as groups of general buyers. But the most important thing is that the price must be reasonable or not too high when compared with other projects in the same location. Condominium projects with the price do not exceed 100,000 baht per square meter. Although there are the highest number of sales open in 2020, but the average take-up rate is still at a significantly higher than projects launched at more expensive levels.

Demand for all types of housing declined following the economic slowdown and counter the concerns posed by the COVID-19 virus. That started to raise concerns again in mid-December 2020 and continued to early 2021. Therefore, various residential projects in particular condominium projects will receive less attention. According to the confidence of Thai people about the long-term economic conditions that have decreased, despite the third – fourth quarter, there were many new condominium projects launched had high take-up rates or sold out. Returning the surveillance of the COVID-19-19 outbreak again during consecutive December and early 2021 affecting developer new investment plan in 2021. Therefore, as of December 2020, as well as in January 2021, many developers have yet to announce new investment or project development plans in 2021.

Price

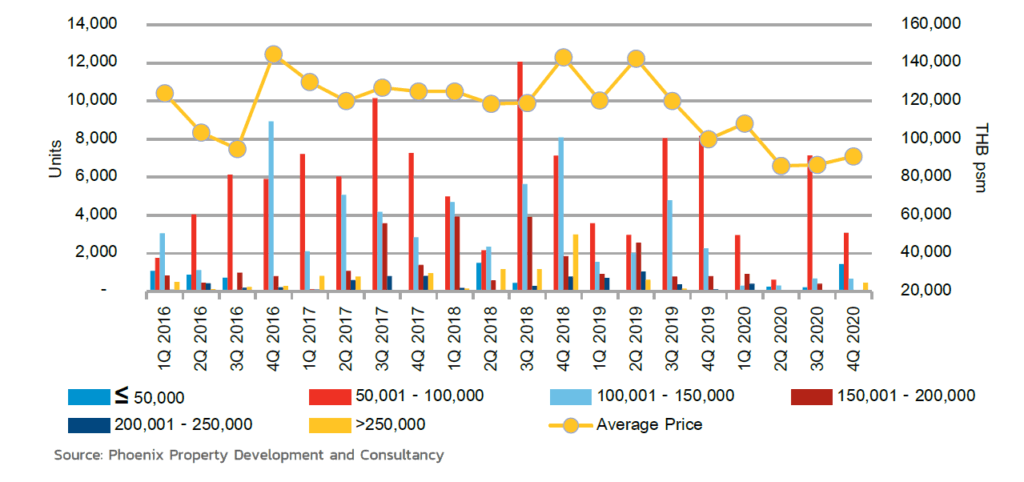

New condominiums launched by selling p rice and average prices by quarter

New condominiums launched for sale in the year 2020, approximately 79% of the price range not exceeding 100,000 baht per square meter. As a result, the average selling price of the newly launched condominium units is approximately 92,000 baht per square meter. It is the lowest average selling price over the past several years.

Although there are some condominiums projects with a selling price of more than 250,000 baht per square meter, but accounted for a very small proportion or only about 2%. Therefore, it does not affect the average selling price of the new condominium projects launched in 2020.

Developers decided to launch new projects in areas along the mass transit routes that are under construction rather than inner-city where land prices are high, so average selling price of new condominium projects in 2020 is not high. Moreover, developers are decided to launch condominium projects in line with most of Bangkok’s purchasing power. Most of buyers were interested in homes that had a selling price of less than 4,000,000 baht per unit. If the price is higher many buyers are will choose to buy a house rather than a condominium.

Popular locations in 2020 in addition to being a location in the line of the mass transit lines that is under construction is also a location that has potential as a community or a location where you can see the potential from the present. May be waiting for the construction of the mass transit station only, but other facilities that has been supported previously.

Summary of Market Overview and Future Trends

Condominium market in 2020 Is in the worst slowdown in the past 10 years

Condominium market will not recover in 2021 and there is a possibility of slowing down

Developers are more focusing on the completed projects with ready to transfer and housing rather than launching new condominium projects.

New condominium units launch in the 2021 it is possible to be in the range of 20,000 – 25,000 units and still waiting to see the situation in the second half of 2021.

The disappearance of foreign buyers has definitely affected some operators who are focused on foreign buyers, especially those that are ready to transfer ownership in 2021.

Developers and foreign investors are still interested in seeking investors to invest in real estate projects in Thailand.

Many Thai developers are open to joint ventures both from abroad and in Thailand to reduce their own investments.

Small and medium-sized entrepreneurs may need to halt project development to cut costs during this period.